V6.1: Refining the Dual Allocator with Better Data and a TLT Guardrail

Part 59 — Iterating on the core strategy with adjusted prices, transaction costs, and rate-shock protection

This is part 59 of my series — Building & Scaling Algorithmic Trading Strategies

This post covers the latest iteration of the Dual Allocator — V6.1. I went through the codebase and data pipeline, fixed a few issues, and added a guardrail for rate-shock scenarios. The result is a cleaner implementation with more realistic performance expectations.

1. What Changed in V6.1

Three main updates:

Adjusted close prices — Now using dividend/split-adjusted data for proper total return calculation

Transaction costs — Added 0.05% cost per position change

TLT momentum guardrail — Checks TLT’s own trend before allocating 100% during high VIX

2. Data Quality Fixes

Adjusted Prices

The original implementation used raw Close/Last prices. V6.1 uses adjusted closes, which captures dividends and splits. QQQ pays ~0.5-1% annually, so this adds up over 16 years.

Missing Data Handling

Previously, missing data defaulted to zero return. V6.1 uses calendar intersection—requiring all assets to have data on a given day before including it in the backtest.

3. The Math Behind the Updates

Adjusted Price Impact

Unadjusted prices miss dividend reinvestment. QQQ’s dividend yield has averaged ~0.5-0.7% annually. Over 16 years, this compounds:

Unadjusted final value: P_0 × (1 + r)^16

Adjusted final value: P_0 × (1 + r + d)^16

Where d ≈ 0.006 (0.6% dividend yield)

Example with r = 0.19 (QQQ's ~19% CAGR):

Unadjusted: (1.19)^16 = 16.17x

Adjusted: (1.196)^16 = 17.85x

Difference: ~10.4% higher total return with dividendsTLT’s yield is higher (~2-3% historically), so the adjustment matters more for benchmark comparisons involving bonds.

Transaction Cost Compounding

The 0.05% per-trade cost seems small, but it compounds against you:

Total position changes: 398 over 16 years

Cost per change: 0.05% (covers spread + slippage)

Naive calculation: 398 × 0.0005 = 0.199 = 19.9%

But costs compound multiplicatively:

Final multiplier = (1 - 0.0005)^398 = 0.819

Effective drag: 1 - 0.819 = 18.1%This explains most of the return difference between V6.0 (no costs) and V6.1 (with costs). The ~200% total return reduction from 2,644% to 2,442% comes primarily from this drag.

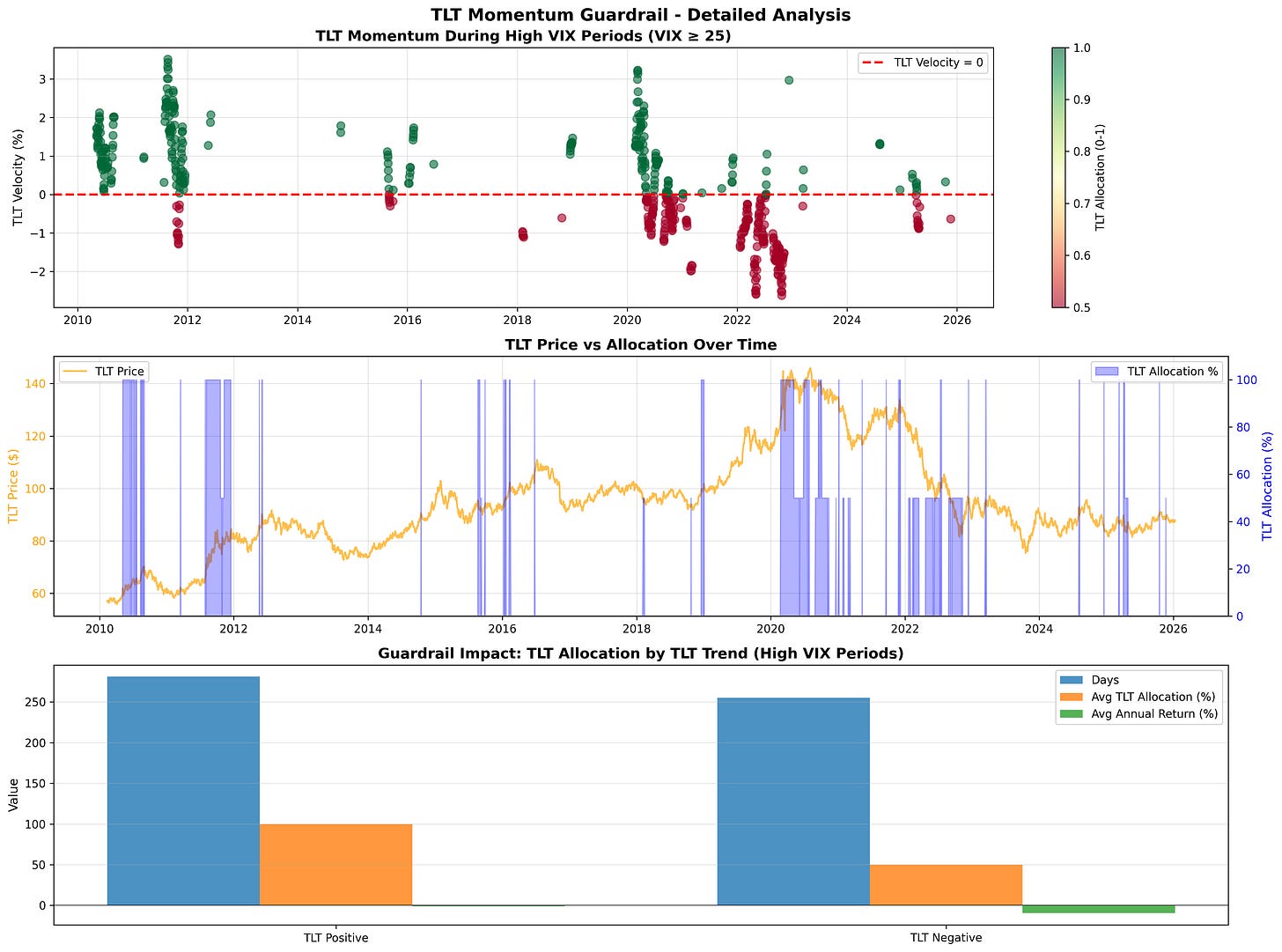

TLT Velocity Calculation

The guardrail uses the same velocity formula as QQQ momentum, applied to TLT:

TLT_velocity = (TLT_MA20[t] - TLT_MA20[t-5]) / TLT_price[t]

If VIX >= 25:

If TLT_velocity < 0:

allocation = 0.5 # TLT falling, reduce exposure

Else:

allocation = 1.0 # TLT rising, full allocationThe 5-day lookback on a 20-day MA creates a smoothed momentum signal that filters out daily noise while still responding to trend changes within 1-2 weeks.

In the 2022 rate shock, TLT’s 20-day MA was falling consistently from January through October. The guardrail would have triggered on most high-VIX days during that period, cutting TLT exposure in half.

4. The TLT Guardrail

V6’s defensive logic allocates 100% to TLT when VIX exceeds 25. This works well in flight-to-safety scenarios (2008, 2020) where bonds rally as equities fall.

The gap: in 2022-style rate shocks, VIX spiked while TLT fell 40%+. The original logic would allocate fully to TLT during exactly the wrong conditions.

V6.1 adds a check:

def determine_position(velocity_pct, vix_level, tlt_velocity):

if vix_level >= 25:

if tlt_velocity < 0:

return 'TLT', 0.5 # Partial allocation when TLT falling

else:

return 'TLT', 1.0 # Full allocation when TLT rising

# ... rest unchangedThis reduced max drawdown by about 4 percentage points in backtesting.

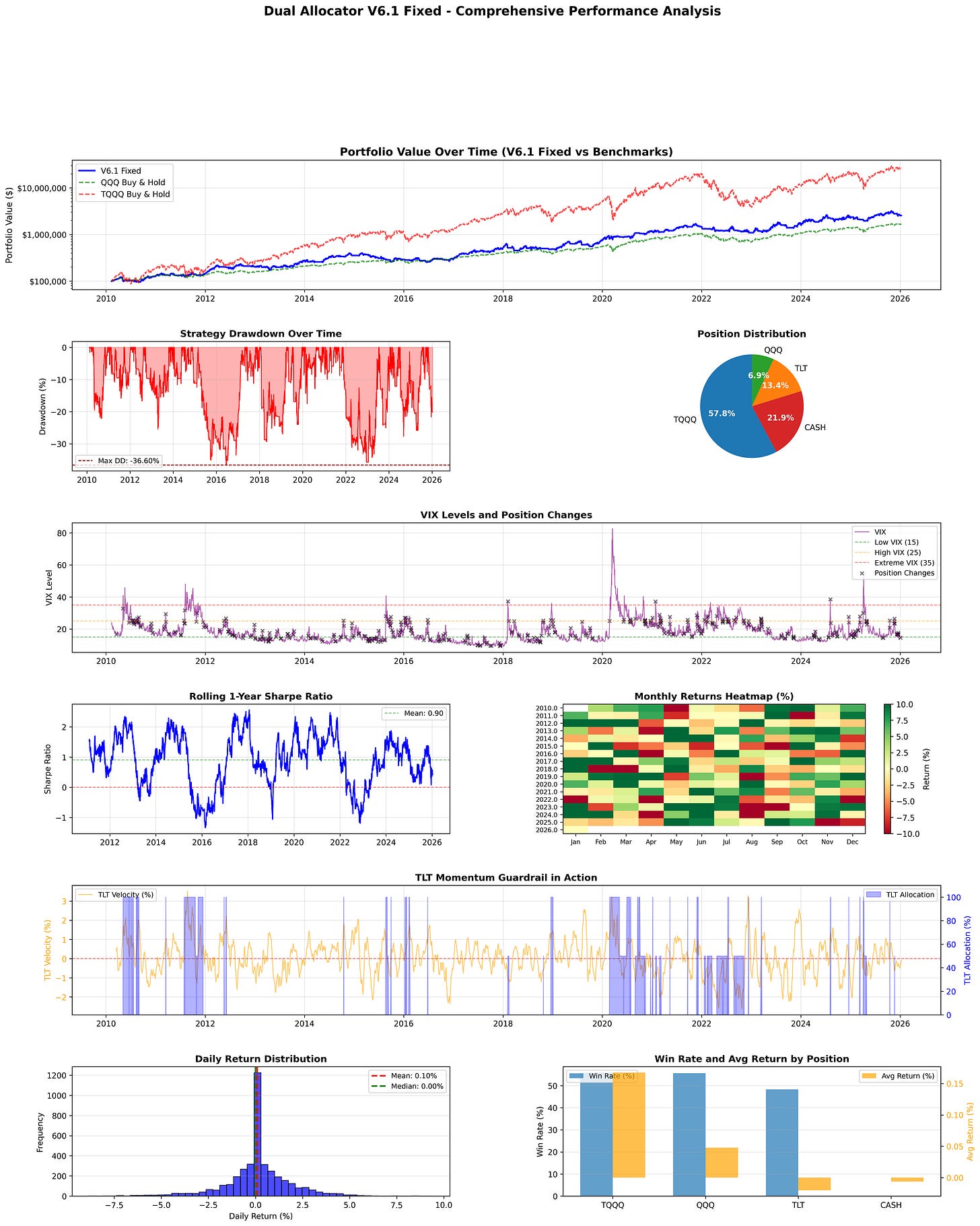

5. Performance Comparison

V6.0 vs V6.1

Metric V6.0 Original V6.1 Fixed Change

──────────────────────────────────────────────────────────

Total Return 2,643.75% 2,442.34% -201%

Sharpe Ratio 0.885 0.874 -0.011

Max Drawdown -40.56% -36.60% +3.96%

Position Changes ~100/yr 398 total

Transaction Costs $0 0.05%/tradeThe return reduction comes primarily from transaction costs (~20% drag over 16 years) and the TLT guardrail occasionally missing bond rallies. The drawdown improvement comes from the guardrail working as intended during rate-sensitive periods.

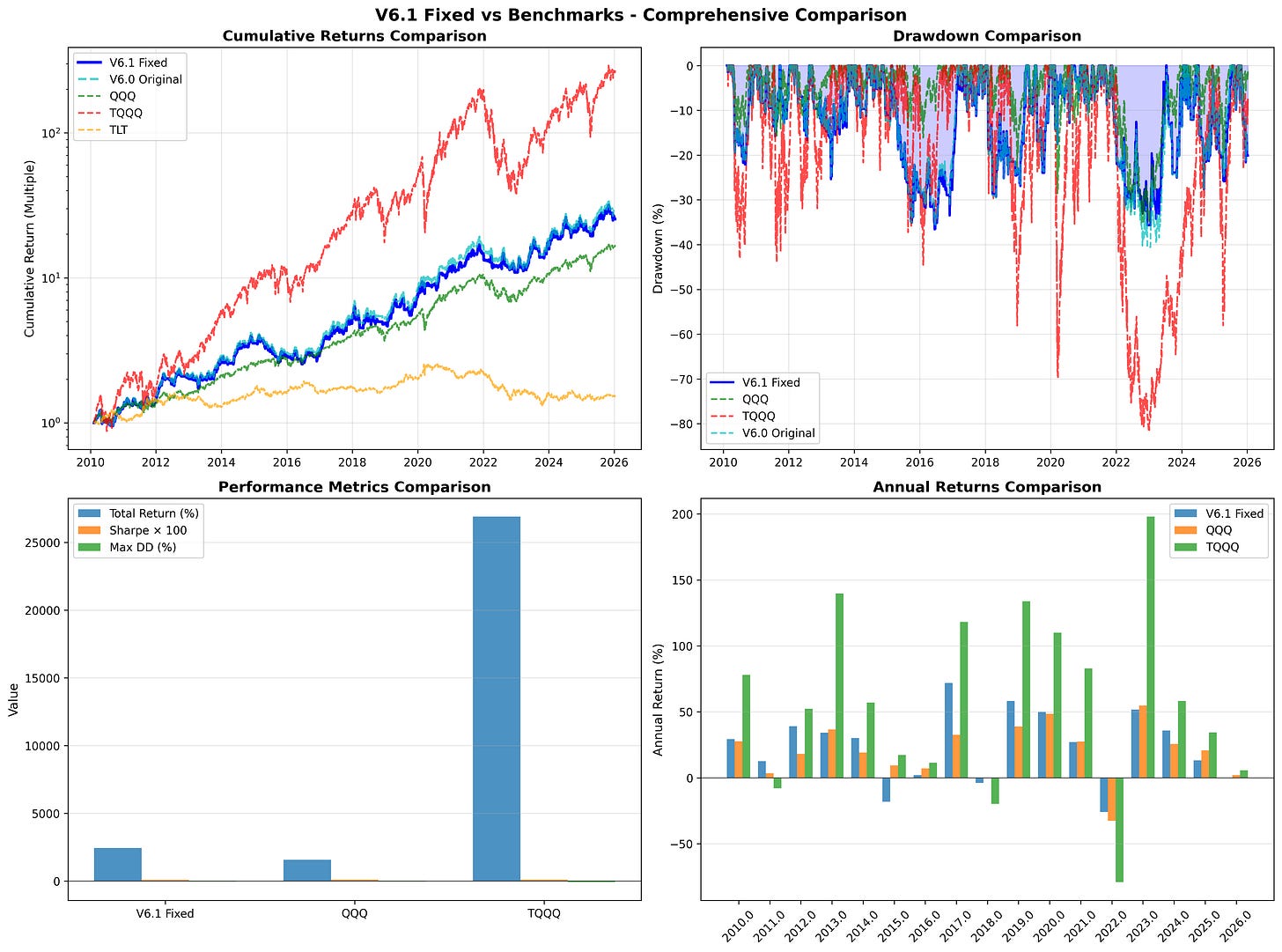

V6.1 vs Benchmarks

Metric V6.1 Fixed QQQ B&H TQQQ B&H

───────────────────────────────────────────────────

Total Return 2,442% 1,576% 26,916%

Sharpe Ratio 0.874 0.964 0.886

Max Drawdown -36.60% -35.12% -81.66%V6.1 sits between QQQ and TQQQ on most metrics. Higher absolute returns than QQQ, much lower drawdown than TQQQ, with Sharpe ratios in a similar range for all three.

QQQ has the highest Sharpe (0.964), which makes sense—it has no transaction costs, no active management drag, and benefits from lower volatility than a leveraged approach.

6. Out-of-Sample Check

Period Sharpe

─────────────────────────────────────

In-sample (2010-2020) 0.99

Out-of-sample (2021-2026) 0.68The out-of-sample degradation is typical for optimized strategies. A Sharpe of 0.68 is still positive risk-adjusted returns—the strategy continues to work, just not as well as the in-sample period suggested.

7. Synthetic Stress Tests

Running V6.1 through extreme scenarios:

Scenario V6.1 Return Sharpe Max DD

────────────────────────────────────────────────────────

2008-style crash +24.3% 0.82 -31.2%

Stagflation +11.2% 0.54 -22.4%

Flash crash + V-recovery +18.7% 0.71 -28.9%

Slow bleed (2000-02) -8.4% -0.31 -19.6%

Rate shock (2022×2) +14.1% 0.62 -24.8%

Melt-up +89.2% 1.24 -14.3%

──────────────────────────────────────────────────────────

Average +24.9% 0.60 -23.5%V6.1 handles most scenarios reasonably. The slow-bleed case (extended low-volatility decline) remains a weak spot for momentum strategies generally—there’s no VIX spike to trigger defensive positioning.

8. Updated Decision Matrix

V6.1 uses the same core logic as V6.0, with the TLT guardrail added:

VIX Regime Velocity > 0.2% Velocity 0-0.2% Velocity < 0%

────────────────────────────────────────────────────────────────────────

Low (<15) TQQQ 100% QQQ 100% CASH

Moderate (15-25) TQQQ 70% QQQ 100% CASH

High (25-35) TLT 50-100%* TLT 50-100%* TLT 50-100%*

Extreme (>35) TLT 50-100%* TLT 50-100%* TLT 50-100%*

*TLT allocation depends on TLT's own momentum: 100% if TLT velocity > 0, 50% otherwise.9. When to Use What

V6.1 makes sense if you want higher absolute returns than QQQ, can handle ~25 trades per year, and are comfortable with active management.

QQQ buy-and-hold makes sense if you prioritize simplicity, want the best risk-adjusted returns (highest Sharpe), and prefer zero maintenance.

TQQQ buy-and-hold only makes sense if you can stomach -80% drawdowns and have a very long time horizon.

10. Next Steps

V6.1 is the current production version. Future iterations might explore:

Adaptive VIX thresholds using rolling percentiles

A 200-day MA filter to catch slow-bleed scenarios

Faster TLT exit signals after flash crashes

For now, V6.1 addresses the main gaps and provides a more realistic picture of expected performance.

Remember: Alpha is never guaranteed. And the backtest is a liar until proven otherwise.

The material presented in Math & Markets is for informational purposes only. It does not constitute investment or financial advice.

The IS/OOS Sharpe drop from 0.99 to 0.68 is familiar territory. I assume haircuts in that range as well. Curious how it performed during the COVID shock - is that the flash crash/V-shaped recovery you mention?